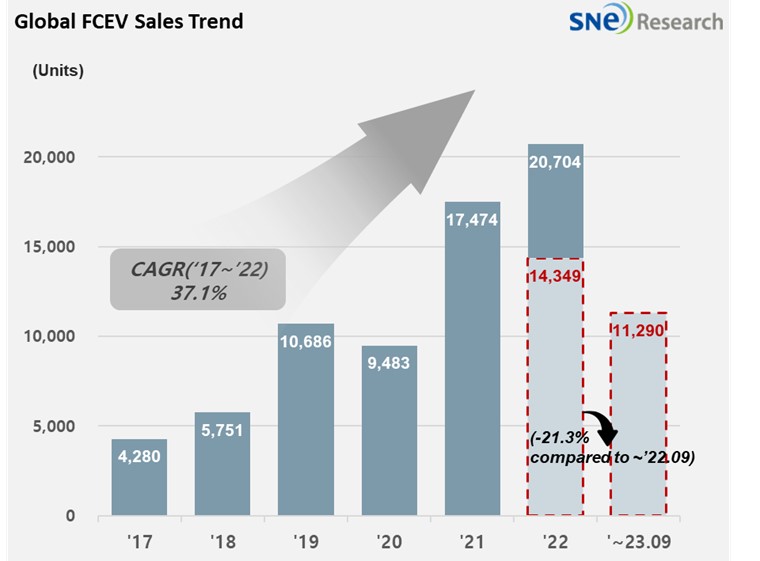

From Jan to September 2023, Global FCEV Market with a 21.3% YoY Degrowth

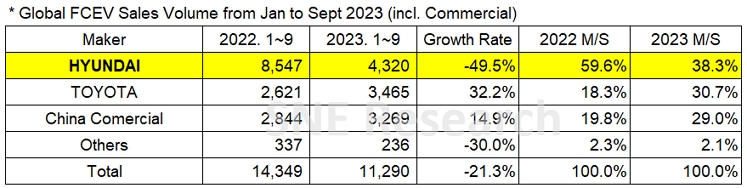

- Hyundai Motor Group took up 38.3% of global FCEV market share.

A total number of globally registered FCEVs sold from Jan to September 2023 was 11,290 units, recording a 21.3% YoY degrowth.

(Source: Global FCEV Monthly Tracker – October 2023, SNE Research)

By company, Hyundai Motors sold 4,320 units of NEXO and ELEC CITY, accounting for 38.3% of market share and staying at the top of the list. However, due to the continued slowdown in sale of NEXO, it posted a 49.5% YoY degrowth. On the other hand, the sale of Toyota’s Mirai has seen a continuous growth since this May, closing the market share gap between Hyundai Motors and Toyota to 7.6%p.

(Source: Global FCEV Monthly Tracker – October 2023, SNE

Research)

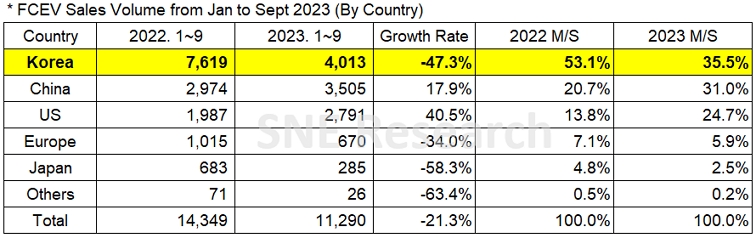

By country, due to the ripple effect from the declining sale of NEXO, Korea saw a 47.3% YoY decrease in its market share, but still taking up 35.5% of the market share and keeping No. 1 position in the ranking. China recorded more than 30% of the market share based on its continuous growth mainly supported by the sale of hydrogen commercial vehicles. The US, where Toyota’s Mirai is sold most, also recorded a growth together with China.

(Source: Global FCEV Monthly Tracker – October 2023, SNE

Research)

Amidst

the transition to eco-friendly vehicles fueled by OEMs based on their strong

will towards achieving the global carbon neutrality, the global EV market has seen

a continuous increase in the EV penetration rate as well as the economy of

scale formed. On the other hand, the FCEV market continued to record YoY degrowths,

failing to meet growth expectations due to the limited availability of FCEV

models and shortage of hydrogen charging infrastructure. What’s worse is that,

due to the increase in global energy cost, the charging cost of hydrogen has

also increased, keeping the vicious cycle of slowdown in FCEV sales. In this

regard, voices from the industry are getting louder, requesting subsidy for

FCEV charging. Even at the National Assembly of Korea, a bill was proposed to

provide financial subsidy to hydrogen passenger vehicles for charging.

As for hydrogen trucks in commercial vehicles, Chinese OEMs, Nikola, Iveco, and Hyundai Motors have shown their will to carry on their R&D effort. As it is expected that the FCEV market would expand mainly with commercial vehicles, attentions should be drawn to changes in competition landscape and market shares of major companies, such as Hyundai, Bosch, and Toyota, who develop the fuel cell system – the key to success of hydrogen vehicles.